Junmin Shi

Associate Professor

Risk Hedging with Asset Portfolio

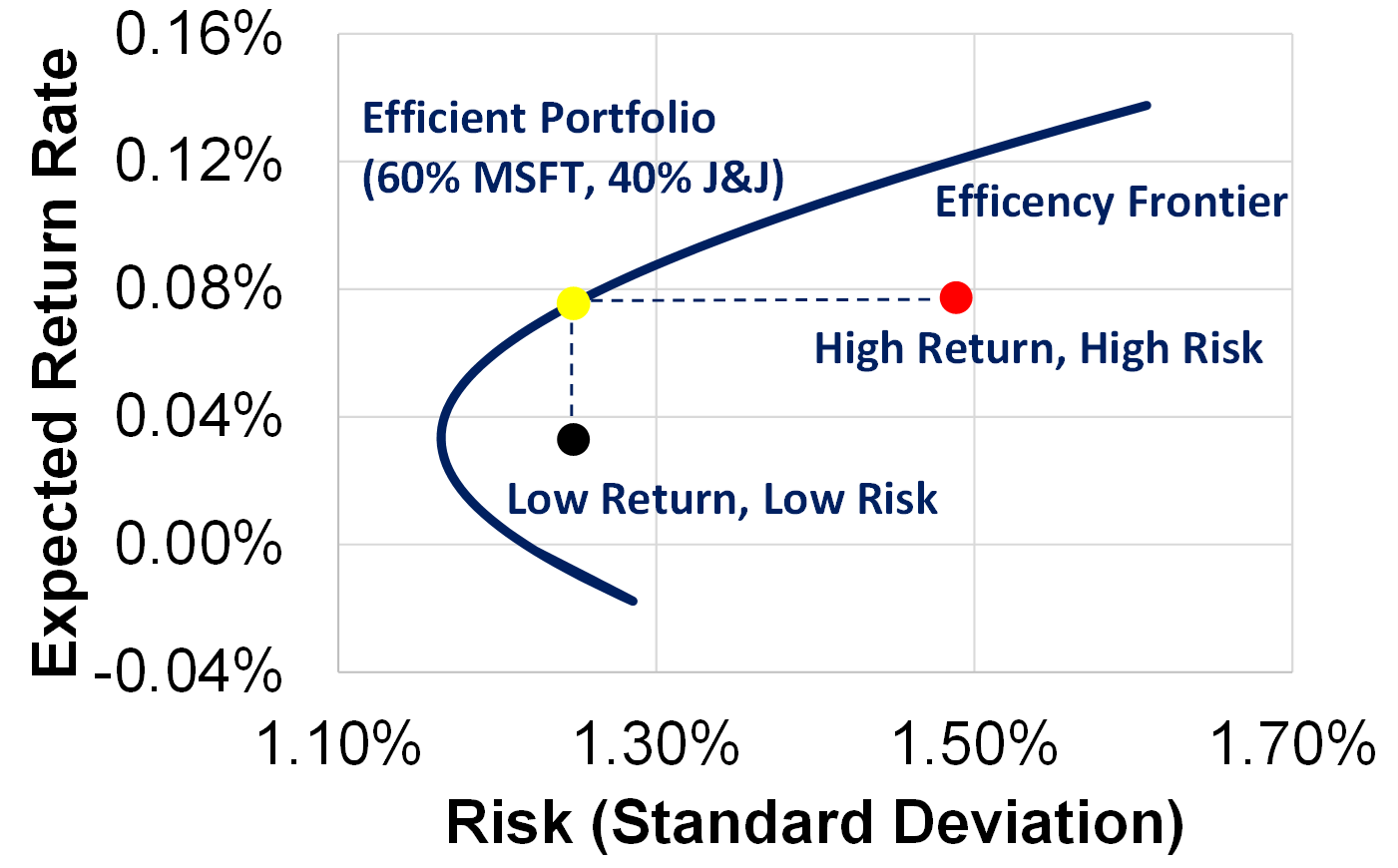

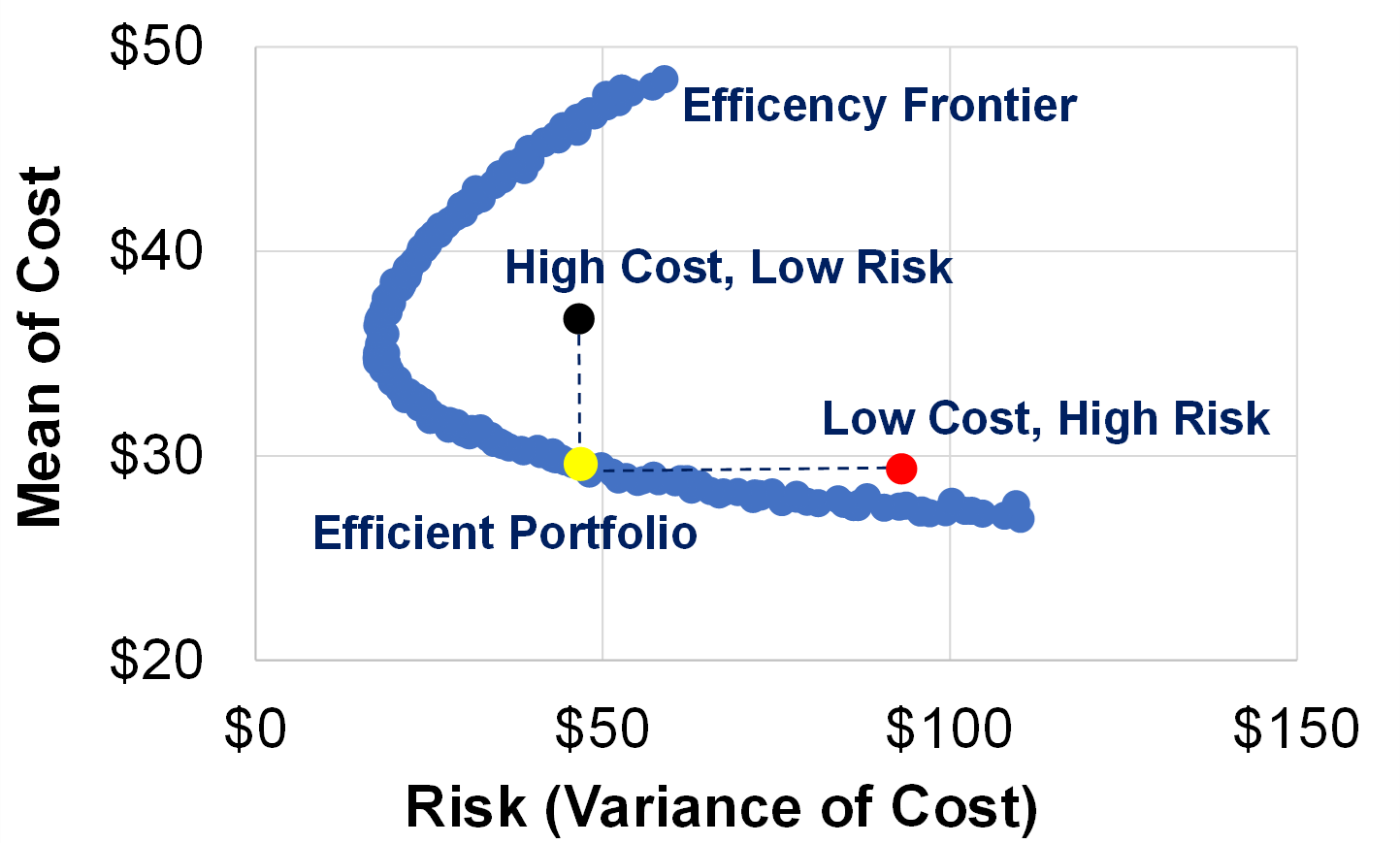

Asset portfolio management involves decision cost evaluation, optimization and asset risk assessment. To illustrate the similarity between the financial Modern Portfolio Theory (MPT) and the power resource portfolio application, a numerical experiment is depicted as below for a side-by-side comparison.

|

|

Fig. 1. (a) MPT results for the portfolio of two stocks: J&J and Microsoft. (b) Power Resource Portfolio: Non-Renewable (Fossil), Renewable (Hydro) and Spot Market.

In this project, we apply neural networks to access the asset risk and apply portfolio theory to assemble assets with various risk profiles. In particular, DRL will be developed to assist the asset portfolio management, where the state consists of the present and historical observations of assets; the reward is a function of conditional value at risk (CVaR); the action when combining assets with different risk profiles, called the asset ensemble. The core idea is to hedge the power level risks through an ensemble of assets with low and high-risk values (as opposed to a single power asset with a known risk) similarly to index or mutual funds.

Dynamic Pricing Strategy for EV Charging Stations

Significant developments and advancement pertaining to electric vehicle (EV) technologies, such as extreme fast charging (XFC), have been witnessed in the last decade. However, there are still many challenges to the wider deployment of EVs. One of the major barriers is its availability of fast charging stations.

A possible solution is to build a fast charging sharing system, by encouraging small business owners or even householders to install and share their fast charging devices, by reselling electricity energy sourced from traditional utility companies or their own solar grid. To incentivize such a system, a smart dynamic pricing scheme is needed to facilitate those growing markets with fast charging stations.

The pricing scheme is expected to take into account of the dynamics intertwined with pricing, demand, and environment factors, in an effort to maximize the long-term profit with the optimal price. To this end, this research formulates the problem of dynamic pricing for fast charging as a Markov decision process and accordingly proposes several algorithmic schemes for (1) Dynamic Programming, (2) Q-Learning, and (3) Actor-Critic.

[1] https://finance.yahoo.com/quote/MSFT/history?p=MSFT&.tsrc=fin-srch